69��ý from low-income families are finding it harder to pay for college as a result of changes in federal student-aid policies and slow growth in federal Pell Grant funding, the College Board said last week in its annual reports on college prices and financial aid.

The report on college pricing found that four-year public institutions managed to slow tuition increases from 10 percent last year to 7 percent for the 2005-06 academic year, with the average tuition and fees increasing from $5,126 in 2004-05 to $5,491 in 2005-06. Tuition at four-year private colleges rose by 6 percent in 2005-06, the same increase as last year, with average tuition and fees increasing from $20,045 to $21,235.

The reports from the New York City-based College Board prompted calls from higher education leaders for Congress to keep federal student aid in line with inflation. Their release Oct. 18 came a day after a federal commission that will examine higher education issues held its inaugural meeting in Washington.

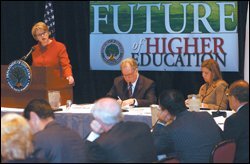

In her remarks at the meeting of the Commission on the Future of Higher Education, U.S. Secretary of Education Margaret Spellings raised the specter of the United States’ falling behind other nations in the high-tech economy, unless this country produces enough skilled workers.

“A college education is more important than ever, and too few Americans, especially too few African-Americans and Hispanics, have one,” she said. Ms. Spellings called on the commission to address the issues of access, affordability, accountability, and workforce preparedness in its final report, which is due next August.

Chairman’s Goals

The 19-member panel—chaired by Charles Miller, a former chairman of the board of regents of the University of Texas system—includes James B. Hunt Jr., a former governor of North Carolina who, during the meeting, urged a focus on the bigger picture of the nation’s needs in higher education before exploring details like college budgets.

Mr. Miller said in an interview that he expected the experience of serving on the commission to be “satisfying but not easy or simple—like taking a sip out of a fire hydrant.”

“I am very comfortable with the fact that this is a complex set of issues and a lot to look at at one time,” he said. “But the good news is there are a lot of people that have done a lot of work in this area, and there are some good studies available. There is a framework here we can build on.”

Mr. Miller, who helped implement a public-accountability system for the nine campuses of the University of Texas in 2003, said that the issues of accountability and affordability are among his personal priorities on the commission. He said he would also look at the possibility of getting the private sector to invest more in higher education.

Less Aid, More Loans

and are available from the .

The College Board’s reports found that the net price—the published price of attending college, including tuition, fees, room and board, less grant aid—of sending a child full-time to a four-year college went up by 6 percent from 1992-93 to 2003-04 for a family with an average annual income of $19,100. For families with an average income of $136,000, the net price over the same period increased by just 1 percent.

The study also found that the proportion of grant aid to undergraduate students has declined each year since 2001, and that such students are increasingly relying on loans.

While students from low-income families receive more grant aid, on average, than students from wealthier families, those from families in the upper half of income distribution have benefited more from recent changes in student-aid policies: As much as 43 percent of federal education tax credits and about 70 percent of the benefits of the federal tax deduction for tuition go to families with incomes above $50,000.

Mr. Miller, who said he had not studied the College Board reports, agreed that the ability of students, particularly those from poorer families, to gain access to college is a critical issue that the federal commission would address under the larger question of the total cost of college.

“College costs are going up higher than the rate of inflation, and we are talking more broadly than just tuition rates,” he said. “We have to look at the cost of the whole enterprise.

“We cannot just shift costs from student to state, and state to the federal government,” Mr. Miller said. “There needs to be maximum efficiency and greater transparency.”

College Board President Gaston Caperton called on colleges and universities to continue working to reduce costs to expand access to higher education.

“In the coming years, our country cannot afford to have segments of our population left out of higher education,” Mr. Caperton said during a press conference held in Washington to release the reports.

Pell Grants Stagnate

The number of Pell Grant recipients increased by only 3 percent in 2004-05 over the previous year, after growing at an average annual rate of 8 percent in the three preceding years, the student aid report says. Meanwhile, the average percentage of tuition, fees, and room and board charges at public four-year institutions covered by the maximum Pell Grant declined from 42 percent in 2001-02 to 36 percent in 2004-05.

The maximum Pell Grant was frozen at $4,050 for the last three years, but President Bush and Congress have promised to increase it next year.

The program, funded at $13 billion in fiscal 2005, is the main source of federal grants to college students.

“Congress has not kept funding for student aid in line with inflation, growing family need, or the swelling tidal wave of low-income and first-generation college students who are academically prepared for college,” David L. Warren, the president of the Washington-based National Association of Independent Colleges and Universities, said in a statement responding to the College Board reports.

There was some good news, however, in a third College Board report, this one showing that the gap in college participation between high school graduates from high-income families and those from low-income homes has declined over time.

But Mr. Caperton warned that extra steps were needed to ensure students from poorer backgrounds stay in college.

“Although there are more students from low-income families with college aspirations and more first-generation college students, we need to do a better job of seeing these students through to graduation,” he said.